Crypto prices retreated in the first 100 days of Trump’s administration as his tariff policies impacted market sentiment.

Bitcoin (BTC) and most altcoins have dropped even as Donald Trump’s administration implemented positive policies, including supportive moves on crypto reserves. The Securities and Exchange Commission has ended lawsuits against prominent companies, including Uniswap (UNI), Coinbase, and Ripple Labs.

However, crypto prices have fallen mainly due to macro factors, as Trump reignited a trade war with countries like Canada, Mexico, and China.

This article highlights the top 5 crypto charts that have defined Donald Trump’s first 100 days in office.

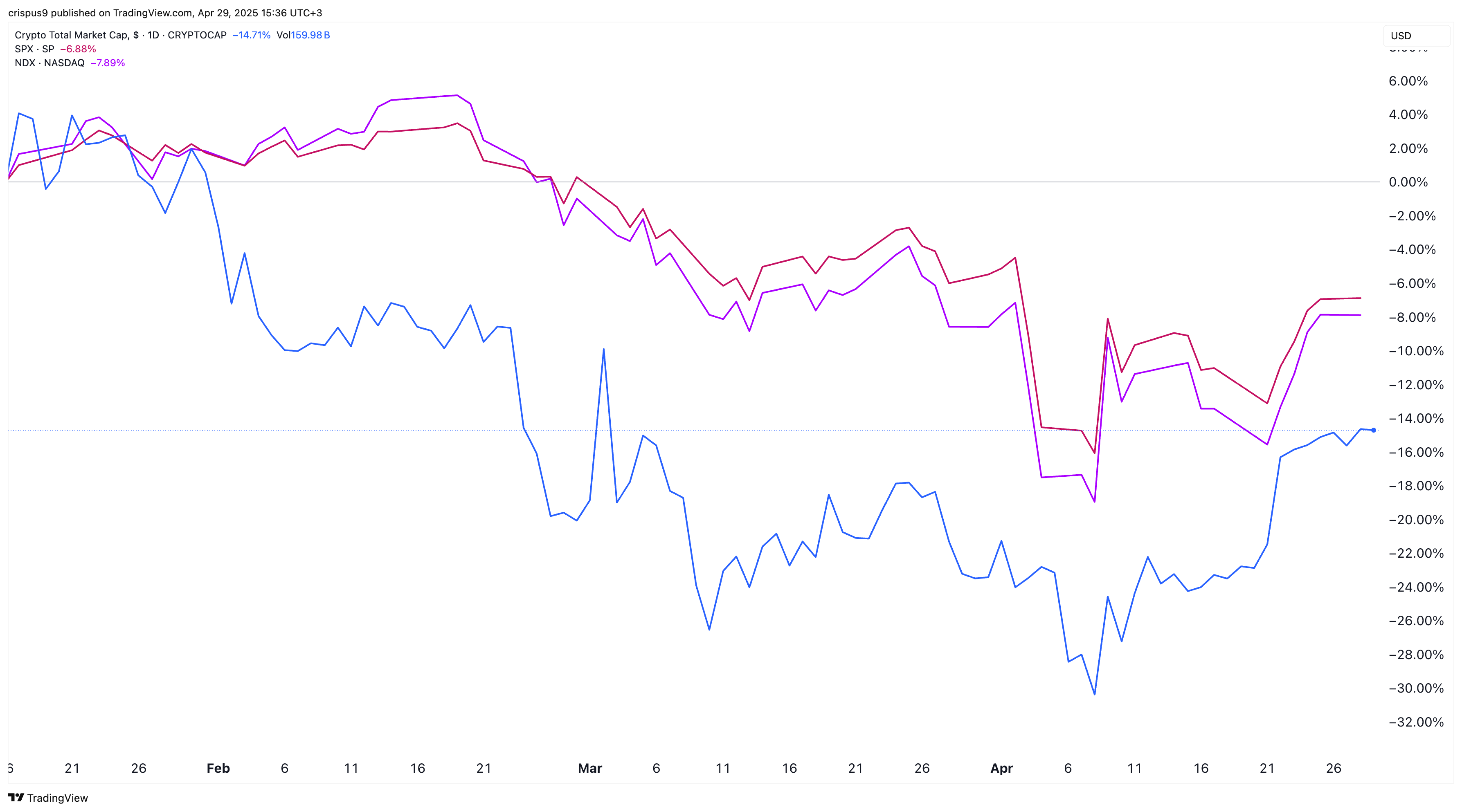

Crypto market cap has crashed by 14.7%

The first chart below shows that the broader crypto market has significantly lagged behind the stock market since Trump took office. The total market capitalization of all cryptocurrencies has dropped by 14.7%, compared to declines of 6.9% for the S&P 500 and 7.9% for the Nasdaq 100.

This performance is notable, considering Trump campaigned on being the “most pro-crypto president” in U.S. history, and his policies have been largely supportive. On a positive note, the crypto market cap has recovered somewhat, rising from $2.39 trillion earlier this month to $2.9 trillion.

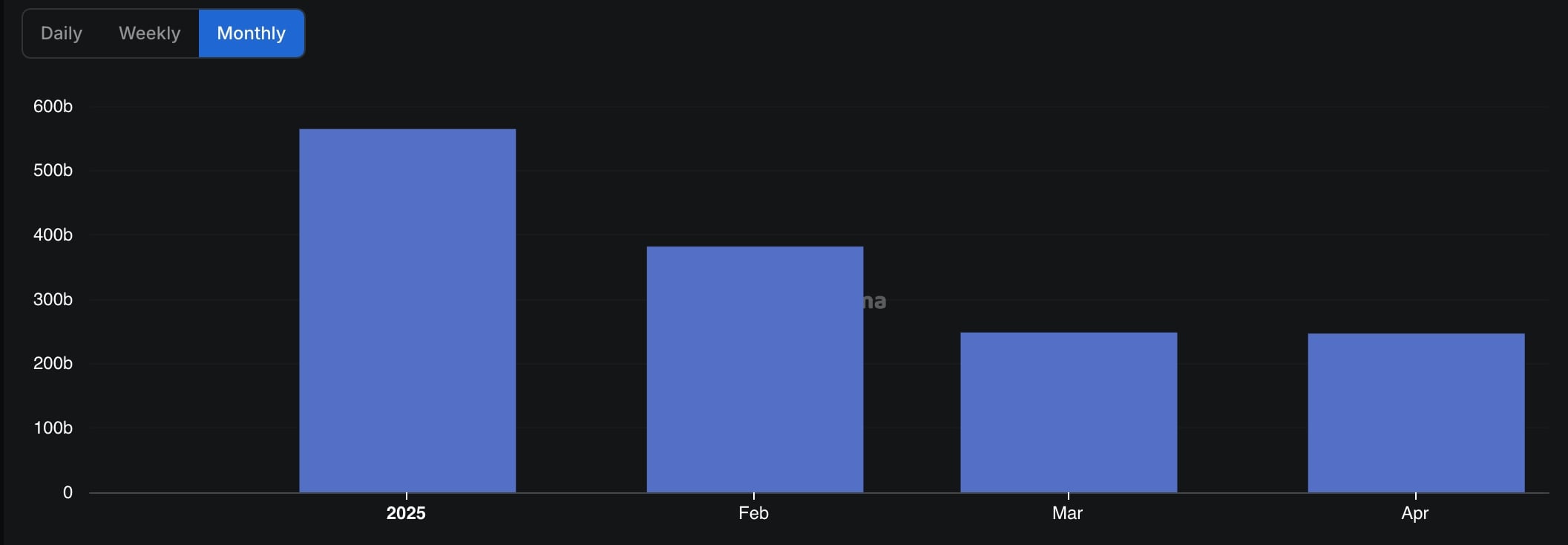

DEX volume has moderated

Decentralized exchanges saw a strong performance in January, fueled by a surge in meme coins. Much of this initial rally was driven by Donald and Melania Trump launching their own tokens ahead of the inauguration.

DEX volume peaked at $564 billion in January, before moderating to $382 billion in February and $248 billion in both March and April as meme coin enthusiasm faded.

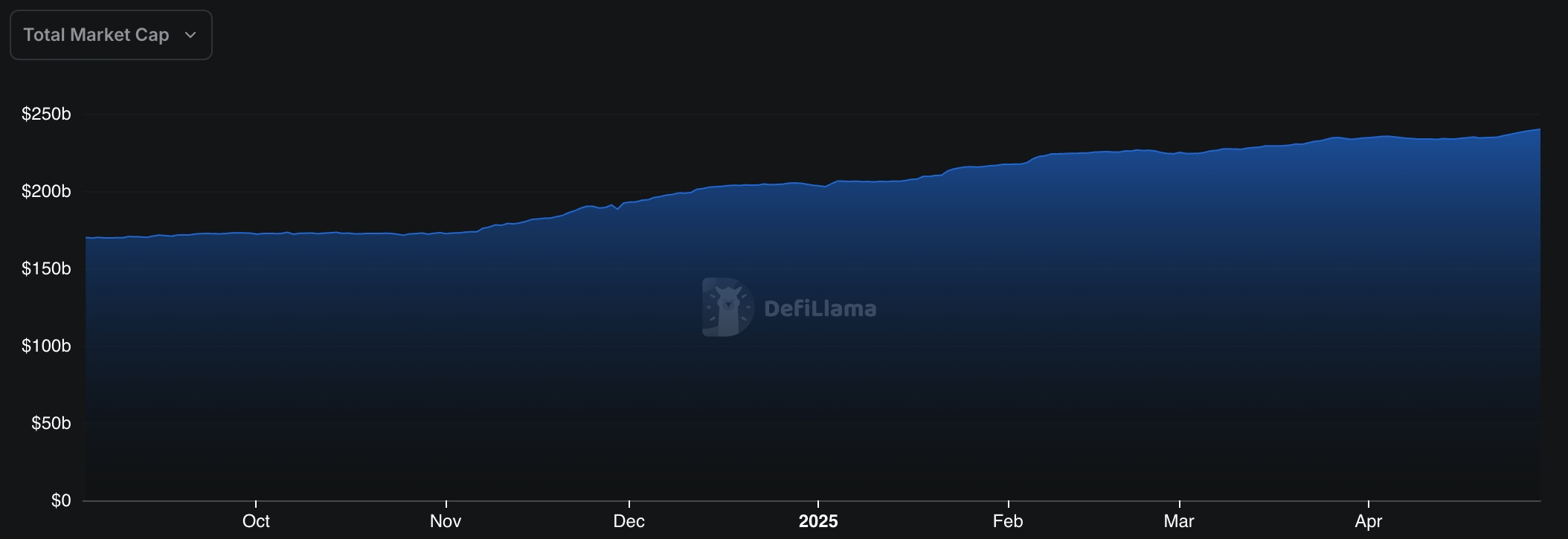

Stablecoin market cap has jumped

Stablecoins have continued to grow under Trump’s administration. Data shows that the total stablecoin market cap has risen to over $240 billion, led by Tether, USD Coin, Dai, Sky Dollar, and Athena. Since Trump took office, stablecoins have added $40 billion in total market capitalization.

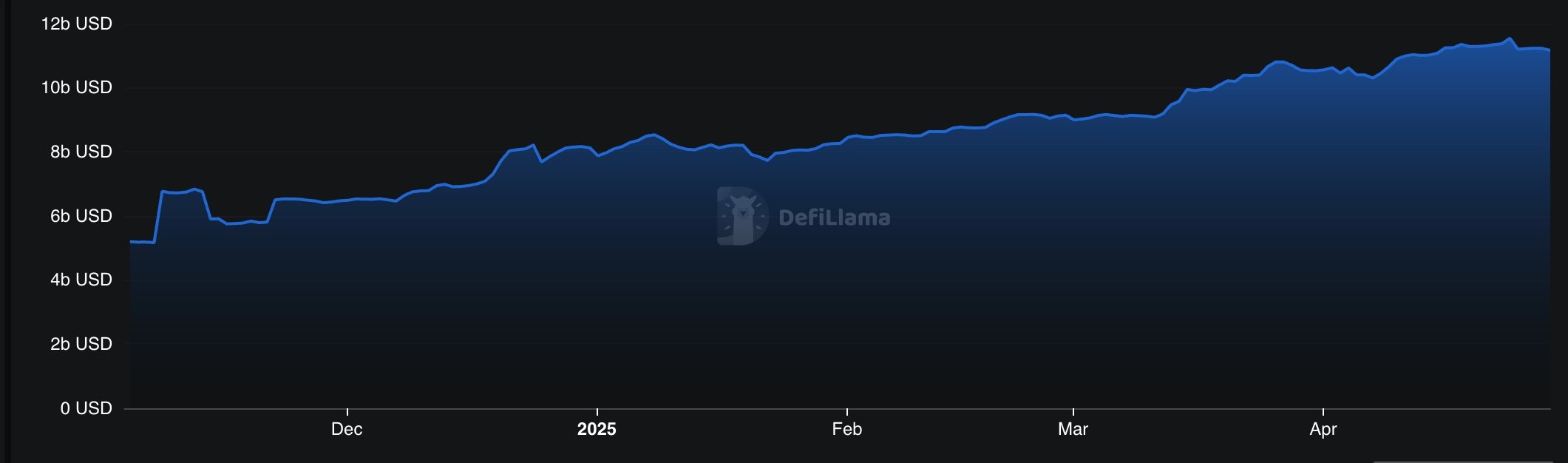

RWA growth has accelerated

Meanwhile, demand for Real World Asset tokenization has grown to a record high. The market value of all RWA tokens has jumped to over $11.17 billion, up from $7.92 billion when Trump took office. The biggest players in the RWA industry are BlackRock BUIDL, Athena USDtb, Ondo Finance, Tether Gold, and Paxos Gold.

One of the top stories in RWA was the collapse of Mantra, one of the biggest chains in the industry.

Bitcoin ETFs had net inflows of $3.73 billion

Spot Bitcoin ETFs have recorded $3.85 billion in net inflows so far under Trump’s administration. After seeing $5.25 billion in inflows in January, the ETFs experienced two months of outflows, but bounced back with $2.85 billion in inflows this month.

Ethereum ETFs, on the other hand, have had net outflows of $132 million. This occurred as the Ethereum price plummeted against the US dollar and other assets, including Bitcoin and Solana.