Lite contract trading is an extremely exciting development, and it is catching all the attention of traders and financial professionals alike. If you are new to Lite Contract trading, this article will help you get started right away. Here’s a guide to BYDFI Lite Contract Trading.

What is BYDFI (previously BYDFI)?

With more than 500,000 users, BYDFI was established in 2014. This platform supports a popular range of currencies and various trading services. BYDFI has made a prominent name in the field of Crypto derivative trading, which is becoming a highly lucrative and popular investment strategy, earning trader’s high returns.

In addition, you can get hands-on with several features like copy trading, and numerous charting tools are available for technical analysis as well, as you can use the demo account to get familiar with features and much more.

Moreover, the platform offers an affiliate program for you to participate in and earn passive income. To make trading faster and easier, you can also download the BYDFI app, which is available for Android and iOS users.

Moreover, BYDFI also ensures a secure environment for its traders to trade in and eliminates safety concerns and implements strong safety measures.

What is Lite Contract Trading?

A Lite trading contract is a seamless way to trade by using trading instruments offered by a platform that permits an investor to trade on the course of prices of the asset, which can either be a financial asset(stocks, bonds, cryptocurrencies) or a physical asset (like crude oil, rice, wheat) at a pre-established future date and price.

Further, in this type of trade, the trader acts as a speculator and derives profits if he makes the correct speculation about the price movement of the underlying asset between the opening and closing trades.

Also, it is identical to futures trading, which comes along with an opportunity to apply leverage.

What trading pairs are available on BYDFI?

The platform claims to meet the demands of its numerous traders and investors by providing various contract trading services. You can trade using ten pairs of cryptocurrencies on BYDFI that include LTC, XRP, BCH, ETC, EOS, BTC, ETH, TRX, DASH, and LINK.

Furthermore, you can also trade with a wide range of cryptocurrencies which is supported more than every other platform.

How to register a new account on BYDFI?

The registration process on BYDFI is simple and straightforward. After you open the website, the registration page will open. Then on the right side, you will find a box that requires you to choose between signing up using your email or mobile number.

Finally, you can enter the BYDFI invitation code to claim an additional bonus for joining the platform.

- Using Email id: enter your email id and create your designated password. Your account will be activated once you receive the confirmation mail and fill in the verification code. Further, you will have to complete the BYDFI KYC verification process to deposit using the fiat currencies.

- Using mobile number: Firstly, click on mobile registration and select your Country/Region and enter your mobile number. Once you enter the verification code that you will receive on your registered phone, all you need to do is set a password for your account, and then you are all set.

How trade Lite contracts on BYDFI?

To perform lite contract trading, you must set the following at the right values to derive profits.

- Limit orders

- Market orders

- Using Stop Loss and Take Profit Ratios

- Opening a new position

- Closing a position

What is a limit order?

Limit orders fulfill the role of entering the market at a requested level which is at a more assenting price than the present price. The trade itself is usually triggered when the mid-price of the live quote reaches exactly or approximately your stipulated amount. You can opt for long and short positions using a limit order.

To simplify what we said earlier, let’s take an example:

Assume you wish to buy the shares of a company currently trading at a price of $1.65 per share. In order to gain Profit, you cannot pay more than $1.60, then you simply place a limit order to buy for $1.60 or better, and then hold back and see if it is fulfilled. You can place an order with a Good till Cancelled (GTC) entry, which means the price remains fixed until you cancel it. If you want to limit your risk, place the trade today so that if it does not go through, you have another trade that you can fund tomorrow.

What is a market order?

As the name suggests, market orders are executed to buy or sell a stock at the best available price immediately.

Further, you have to set the margin that you wish to execute the trade with, and then your position size is automatically calculated, taking into consideration the leverage you use.

What is Stop Loss and Take Profit Ratios?

A stop-loss order is a defensive mechanism that can be initiated to protect an order against more profound losses, including margin closeouts. A stop-loss order is often used to protect a long position from being closed out before a market reversal or drop in the stock price.

Take-profit orders are helpful for short-term traders who want to profit from the cost of security going up. These are limit orders that are closed when a specified profit level is reached.

With these ratios, your investment becomes less risky. Under the “Initial Margin” tab and from the settings button on top, you can adjust them.

What is Opening a new position and Closing a position?

By opening a position, you open your trade investment to draw profits or incur a loss from the rising as well as the falling market movement of the prices. However, when you are closing a position, the trade is no longer active, and all profits and losses are realized. All you need to do is click on the buy button, which will lead to your open position, which you can find below the chart.

Further, you are also allowed to alter the Stop Loss and Take Profit targets you had set. If you wish to close your position, you can either let the price meet the stop loss or take Profit; simply close it by clicking on the “close” option using the current market price.

BYDFI: Trading fees

- This platform charges its users an Opening fee and a Closing fee that’s the same as it does not differentiate between the market makers and market takers.

- Based on your actual position size, this platform charges you a fee of 0.05%, which is subtracted in advance at the time of opening a position.

- Furthermore, you can also calculate the fees charged using the formula Margin x Leverage x 0.05%.

- Compared to its alternatives, the fee charged by BYDFI is pretty high.

Conclusion

Lite contract trading is an excellent way to take advantage of market fluctuations if you know how to do it right. Although this platform offers competitive pricing compared to its alternatives, BYDFI is still among the best contract trade platforms in the market, with amazing features, trading pairs, and services that you should definitely try!

Frequently Asked Questions

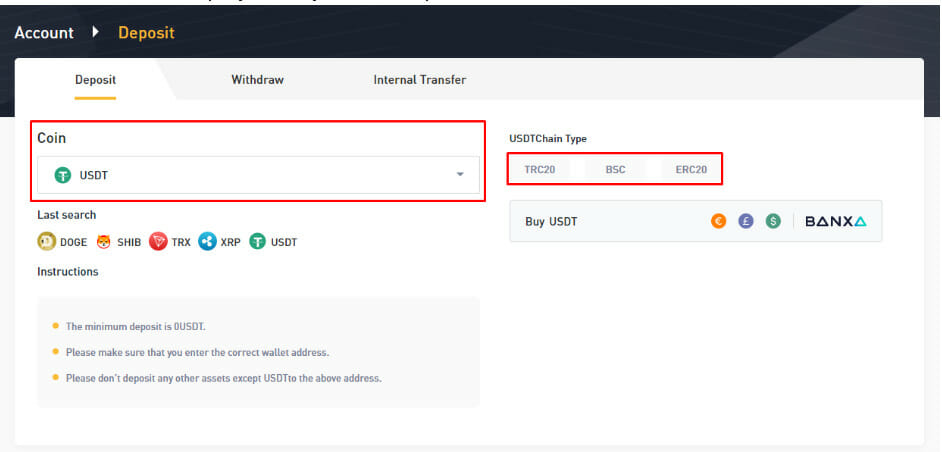

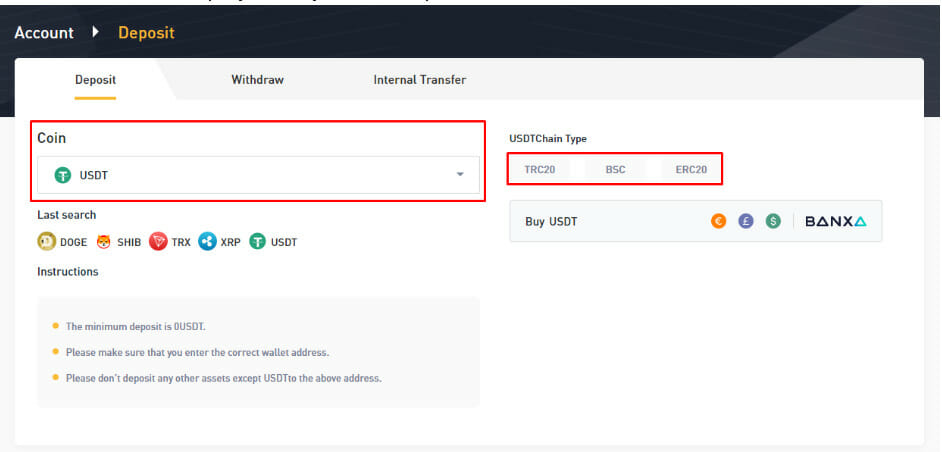

How to deposit from BYDFI?

If you are using the app, then on the home page, you will find and select deposit and confirm the currency you want to deposit. After you choose the chain and coin, you will find the deposit address at the bottom of the page.

How to withdraw from BYDFI?

For BYDFI withdrawal, Click on “withdraw” on the Assets page. Next, choose your currency by clicking on “Select Coin .” Further, enter your “Withdrawal Address,” “Amount,” and “Fund Password,” and hit “Confirm” to complete. BYDFI withdrawal time 9:00 – 21:00 in Singapore time (UTC+8).

Is BYDFI legit?

Yes, BYDFI is legit and is considered a secure platform that is suitable for all types of trading. The platform is easy to use, a beginner-friendly platform with excellent features. Moreover, you will find a wide range of excellent trading pairs.