If you’ve been watching markets and feel like they’ve lost the plot, you’re not alone. Bitcoin jumped over 6% in 24 hours, breaking above $94,000 on April 23, its highest level since March, before easing slightly to current levels. It broke out of its month-long trading range just as macro uncertainty peaked.

Signals clashed. Logic folded. The usual correlations began to fray. Bitcoin, the digital wildcard once written off as pure speculation, surged. Stocks rose, then fell, reacting more to tweets and headlines than to earnings or data. The dollar slipped, with the U.S. Dollar Index (DXY) hovering near 99, down from over 105 in late March. And the Fed found itself back in the spotlight, enduring a verbal barrage from the president, who branded its chair a “major loser.”

It’s tempting to read crypto’s rise in isolation. But what’s happening is bigger. It’s a symptom of a market system where risk, safety, and strategy no longer play by the rules.

When risk-off becomes risk-on

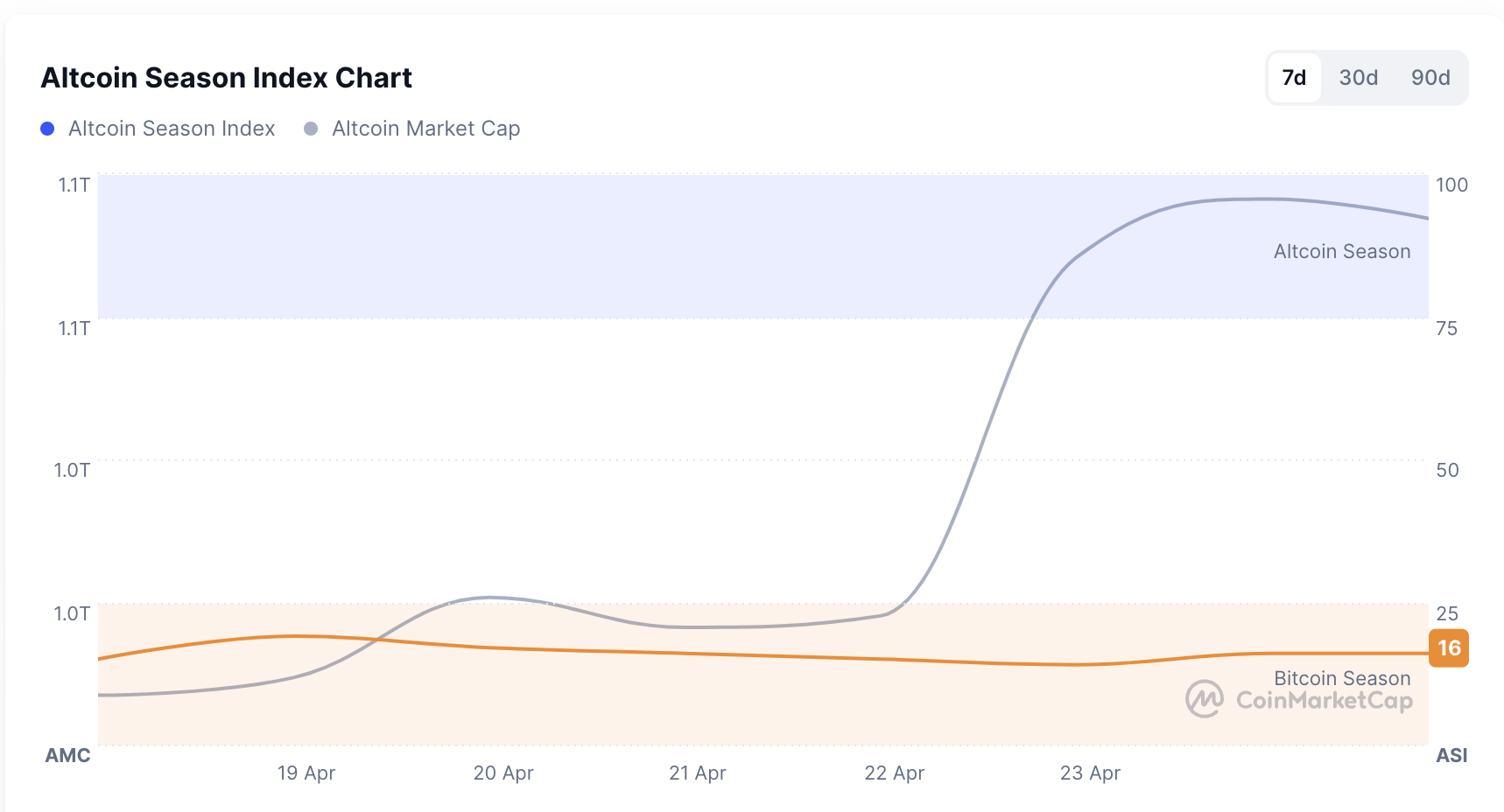

Normally, when equities drop and geopolitical tensions flare, investors flock to safe havens, cash, treasuries, gold. Not Bitcoin. And yet here we are: BTC is up in a single day, and the broader altcoin market has followed, the total altcoin market cap rose from $997.56 billion on April 22 to $1.04 trillion on April 24.

The Altcoin Season Index sits at 12, proof that this is a Bitcoin-led move. Investors aren’t rotating into crypto for fun. They’re hedging against politics, confusion, and a dollar losing its grip. And against the feeling that no one, not even Powell or Trump, knows what happens next.

Bitcoin finally goes its own way?

A month ago, Bitcoin’s 30-day correlation with the S&P 500 hovered around 0.9, almost indistinguishable from the major stock indexes. But by April 22, that figure had sharply declined. The correlation with the S&P 500 dropped to 0.35, with the Nasdaq Composite to 0.34, while the correlation with gold climbed to 0.39.

But here’s where it gets interesting: gold spiked to a record $3,500 on April 22, then fell sharply as the dollar rebounded and stocks rose. Bitcoin didn’t flinch. It held its ground, echoing equities more than bullion. The takeaway is that Bitcoin isn’t copying gold or tech. It’s interpreting the noise in real time, with its own kind of logic.

This makes Bitcoin’s divergence all the more striking in a macro landscape shaped by protectionism, tariff threats, and mixed messaging on trade. After Trump imposed a sweeping 145% tariff on Chinese goods, Beijing retaliated and accused the U.S. of unilateralism, demanding all tariffs be lifted. Treasury Secretary Scott Bessent denied any plans for unilateral cuts, calling the current setup “the equivalent of an embargo” and “unsustainable.”

Meanwhile, Trump himself hinted at tariff de-escalation, calling 145% “too high” and promising to be “very nice” to China, only for China to reject all overtures as “groundless.” The result? Market confusion and diplomatic gridlock. Investors saw gold spike before pulling back as Bessent’s comments boosted the dollar and stocks.

Amid the chaos, Bitcoin remained steady. Like a generator in a blackout, it held firm while sovereign assets twisted with every headline. Untethered from policy posturing, it’s showing what it means to move outside the old script. So has Bitcoin finally gone its own way? It may be too early to say definitively, but the signs suggest it’s beginning to.

Powell, politics, and the Fed’s fragility

Political targeting of central banks is new terrain. Fed Chair Jerome Powell is under direct attack from Trump, who accuses him of political sabotage and hints at his replacement.

Yet amid the backlash, Trump has also tried to reassure markets, stating he has “no intention” of firing the Fed Chair — at least for now. The mixed messages only heighten the atmosphere of uncertainty — forcing investors to think about where monetary policy might go when the referee is being booed off the field.

Bitcoin, meanwhile, keeps inching higher. It’s not that investors suddenly trust crypto more — they just may trust it more than the headlines.

Greed for Bitcoin returns

Alongside Bitcoin’s breakout, investor sentiment has flipped sharply. In just one week, the crypto market sentiment has jumped from Fear to Greed. As of April 24, 2025, the Bitcoin Fear & Greed Index sits at 63, firmly in “Greed” territory, while CNN’s Fear & Greed gauge for U.S. equities remains in “Fear” territory at 28.

But this isn’t classic bull euphoria, it’s survival optimism. Investors aren’t buying Bitcoin because the future looks bright. They’re buying it because everything else looks worse.

This makes the shift in correlation with gold even more profound: it signals that greed isn’t fueled by momentum, it’s fueled by macro anxiety.

The end of market logic?

This could be the real takeaway: the cycle might be dead. We used to expect post-halving rallies, altcoin seasons, and ETF-driven hype. But it seems that this rhythm is gone and investors aren’t playing the old game.

Instead, they’re preparing for a different one, one where the dollar weakens, trade decouples, central banks become political battlegrounds, and the only rational bet is something that sits outside the system.

Final thoughts

Markets usually move on patterns. But what if the pattern now is dislocation itself? What if Bitcoin’s strength isn’t a sign of investor confidence, but of investor disillusionment?

That’s what makes this moment so important. It’s not just a rally. It’s a referendum.

And for now, Bitcoin, that old symbol of rebellion, might be the closest thing we’ve got to rationality in a world where everything else has gone mad.