With import levies as high as 46% and capital flowing to low-risk Bitcoin exposure via ETFs, miners are confronting a tightening squeeze on both cost and funding fronts.

Bitcoin (BTC) miners in the United States are facing two major challenges at once: rising equipment costs due to import tariffs and growing competition from financial products like ETFs, according to a new report by Bitwise.

In the report, Bitwise‘s head of research André Dragosch and research analyst Ayush Tripathi, note that with an estimated 40% of global hashrate operated by American mining firms, the industry “is facing levies of 24-46% on imported mining equipment from Vietnam, Thailand, and Malaysia.” These tariffs come at a time when hashprice, the key profitability metric for miners, is “at all-time lows,” the report reads.

Investor interest is also shifting away from miners. With spot crypto exchange-traded funds and corporate treasuries like Strategy and Metaplanet absorbing investor demand, Bitcoin miners “now face intense competition on the capital front,” the analysts say.

“These firms can accumulate BTC using low-cost equity issuance or convertible debt, offering investors immediate exposure to price appreciation without the operational risks of mining. This crowds out miners, who must finance heavy upfront capital expenditures, navigate uncertain regulatory terrain, and wait months or even years for their investment to pay off.”

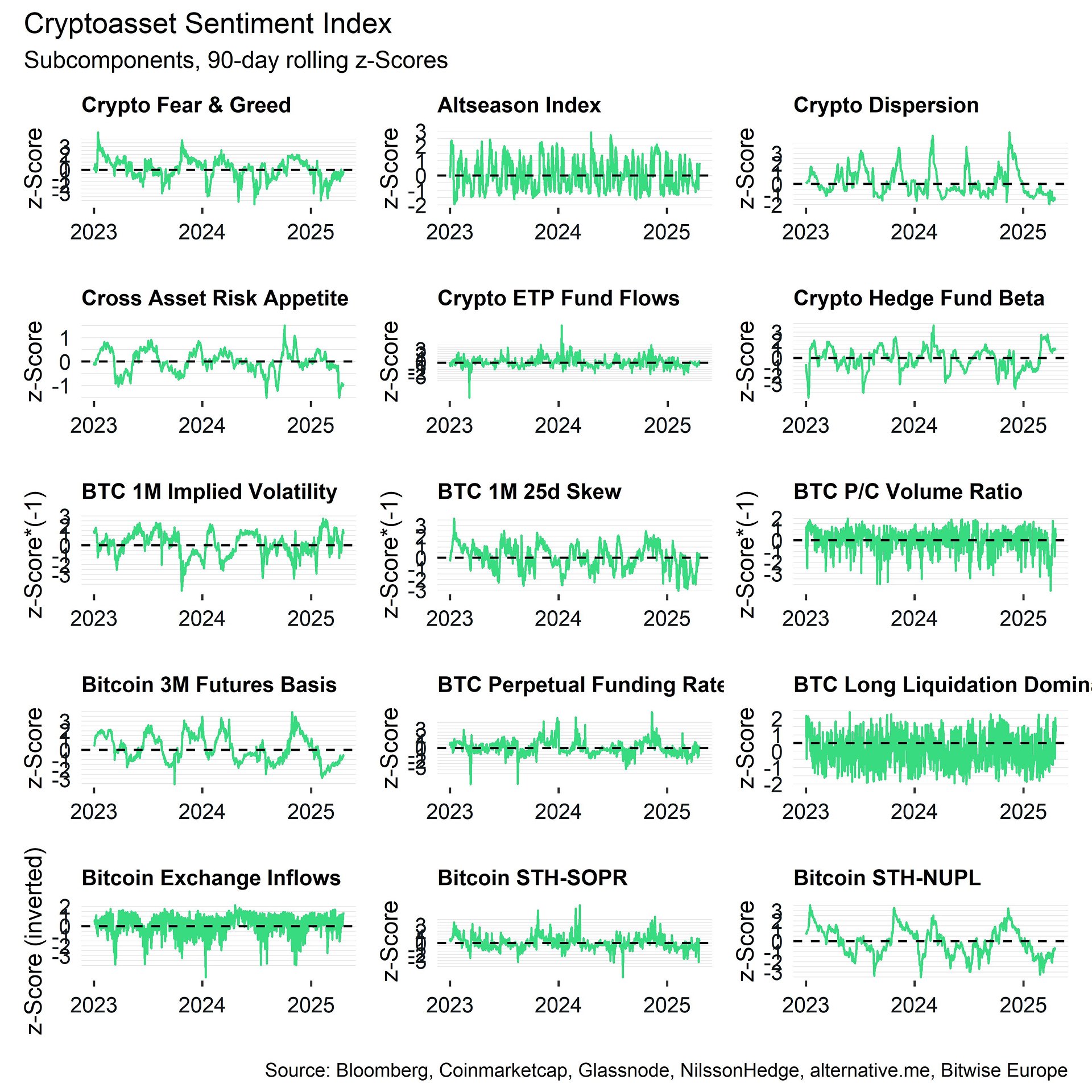

Bitwise

Some firms are adapting to the new conditions though. Bitmain-backed crypto miner Bitfufu, for instance, is looking into redirecting machines to Ethiopia, while Bitdeer is prioritizing Norway and Bhutan.

Riot and CleanSpark, two U.S.-listed miners, absorbed the initial tariff impact by accelerating shipments pre-deadline, Bitwise notes. Still, despite these efforts, the outlook remains difficult as miners are clearly “bracing for more pain,” Bitwise concluded.