Volatility has always been one of the first things mentioned in various Bitcoin drawbacks lists. According to a recent Ark Invest report, Bitcoin’s volatility reached its lowest level ever. What are the implications of low volatility?

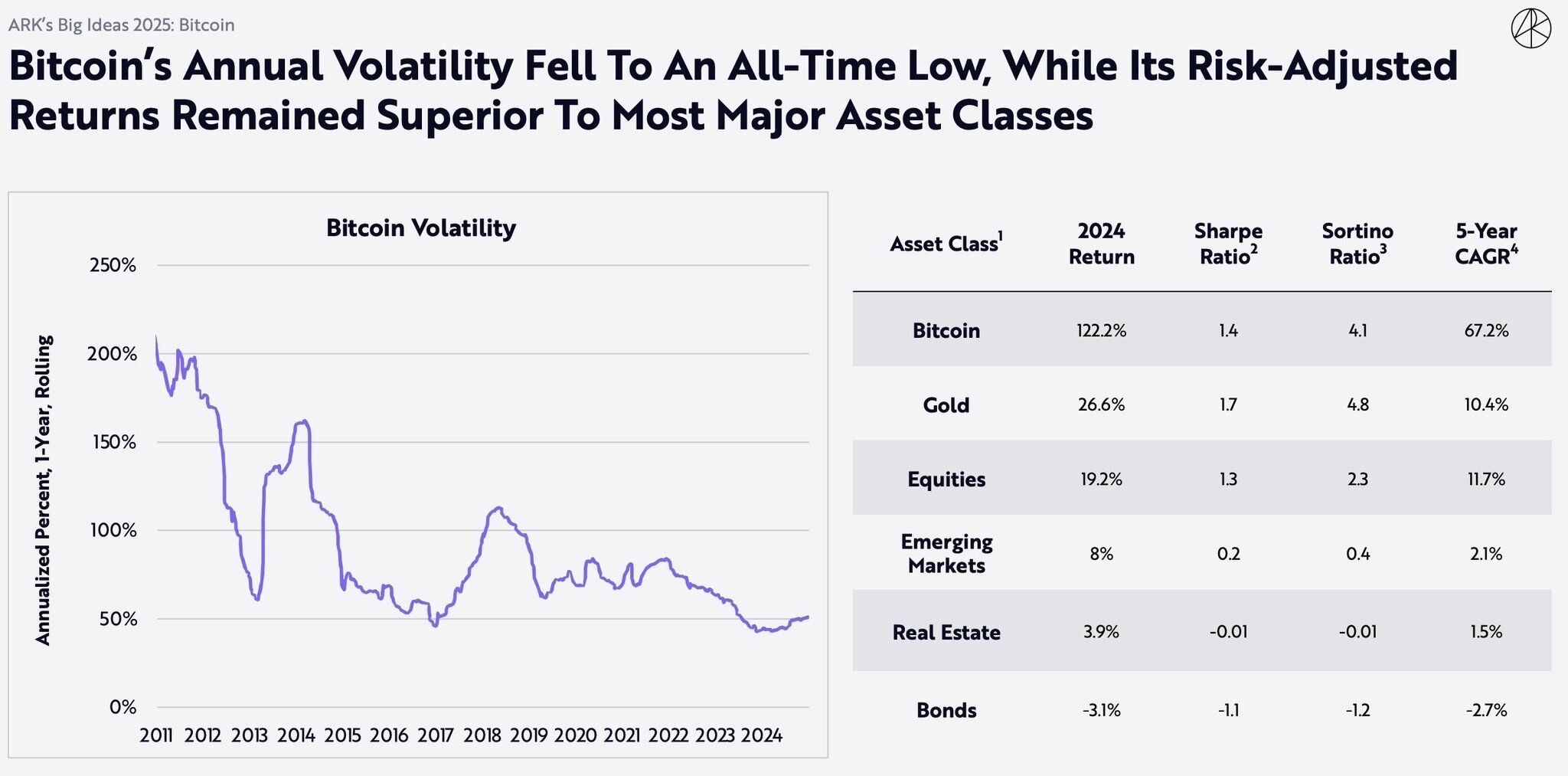

The new Ark Invest’s report, called Big Ideas 2025, outlines that the 30-day moving average for Bitcoin was generally below 50% in 2024 and the first months of 2025. Overall, the graph indicates a gradual decline in volatility.

Some will miss Bitcoin’s volatility

Volatility is seen as an opportunity by investors to take high stakes and risks in hopes of bigger wins. A prominent Bitcoin advocate and one of the biggest Bitcoin investors, Michael Saylor, once called Bitcoin’s volatility “a gift to the faithful” that scares away the tourists, lazy, and conventionally rich people who have all the money. He effectively called those who wanted Bitcoin’s volatility to go away “arrogant” and “egotistical.”

Notably, Saylor claimed that Bitcoin is a digital capital, not a currency, not a means of exchange. Nevertheless, Saylor is actually a beneficiary of low volatility as the company he co-founded, Strategy (formerly known as MicroStrategy), may face serious troubles if the BTC price nosedives.

Bitcoin price stability doesn’t equal a lack of returns, though. Ark Invest’s report outlines that despite the volatility drop, Bitcoin’s annual returns for 2024 reached 122.2%, outpacing gold, bonds, and equities. More than that, Bitcoin’s Sharpe and Sortino ratio evaluations were only slightly below respective gold’s figures while being well ahead of bonds and equities by this metric, showcasing market strength and relatively low risk.

However, if you look at the three best years in terms of Bitcoin returns, you will find out that the reward is declining steadily. The year 2013 saw 5,428.7% in returns, 2017 brought “only” 1,336.4%, and the third-best year, 2020, saw a 304.5% annual returns rate.

These figures indicate that a decrease in volatility is paralleled by a reduction in short-term investment revenue. It can be seen as bad news for high-risk traders, while generally, low volatility has been long anticipated and perceived as a maturity phase of Bitcoin.

Bitcoin gets mature

There are several reasons why the volatility drop is perceived as a sign that Bitcoin is maturing. First off, a stable price makes Bitcoin viable for daily transactions. Sudden spikes and busts are not healthy grounds for merchants and consumers, as they change the local currency evaluation of goods and services within short periods of time. If you buy a laptop for $1,000, you don’t want to find out next week that its price has dropped to $600 while the dollar’s value has not changed.

Stable Bitcoin has a higher potential for wider adoption across various businesses. The growing adoption increases liquidity and the pool of retail options for customers. Let’s say that you are going to buy a laptop and pay for it in Bitcoin, and you have access to only one shop; you will have to pay whatever price the shop requests for the laptop you choose. Ten different shops would increase the probability that you will find a quality laptop at an affordable price.

On top of that, the Bitcoin derivatives market will further settle down price fluctuations. Combined with growing retail adoption, Bitcoin will help establish itself as a reliable settlement tool rather than just a speculative asset. None of these puts long-term growth potential in jeopardy. Rather, it cements a higher support level that replaces stark fluctuations.

The Wolf of All Streets podcast host Scott Melker mentioned in his daily newsletter that while Bitcoin’s price became somewhat aligned with major indexes, “it still stands out as an uncorrelated asset,” pointing at relative stability in such a turbulent period as the Q1 of 2025.

The trade war intensified on April 2, when Donald Trump announced unconditional tariffs for dozens of countries, causing growing investors’ fear. The first weeks of the months were marked with market shakeups across the globe unseen in years and decades, and unprecedented liquidation rates. Nevertheless, Bitcoin signaled a strong and consistent ability to recover in mere days or even hours.

It may be a sign that headlines are losing their power over the price action. Some experts even see it ironically, noting that post-election crypto news feeds had lots of bullish headlines, but the rally turned out to be relatively moderate. Now we see that in a shaky period, Bitcoin rarely leaves an $83,000–$87,000 range, showcasing a solid composure.