The price of Ethereum has remained in a tight range over the past few days, despite an increase in exchange-traded fund (ETF) inflows.

Ethereum (ETH) was trading at $2,400, a level it has remained at for the past few days. This price is about 15% below the highest point this month.

The token has consolidated, even as data shows that Wall Street investors are increasing their positioning in Ethereum ETFs. Ethereum ETF inflows rose by $283 million last week, a big increase from the previous week’s $40 million.

These ETFs have had inflows in the last seven consecutive weeks, its longest winning streak ever. They added $1.13 billion in inflows in June, higher than May’s $564 million and April’s $66.2 million.

This growth has resulted in cumulative inflows since September exceeding $4.1 billion. It has also brought the total net assets to over $9.88 billion, with BlackRock’s ETHA having $4.25 billion.

The rising ETF inflows are a sign that these investors anticipate that Ethereum’s price will bounce back in the near term.

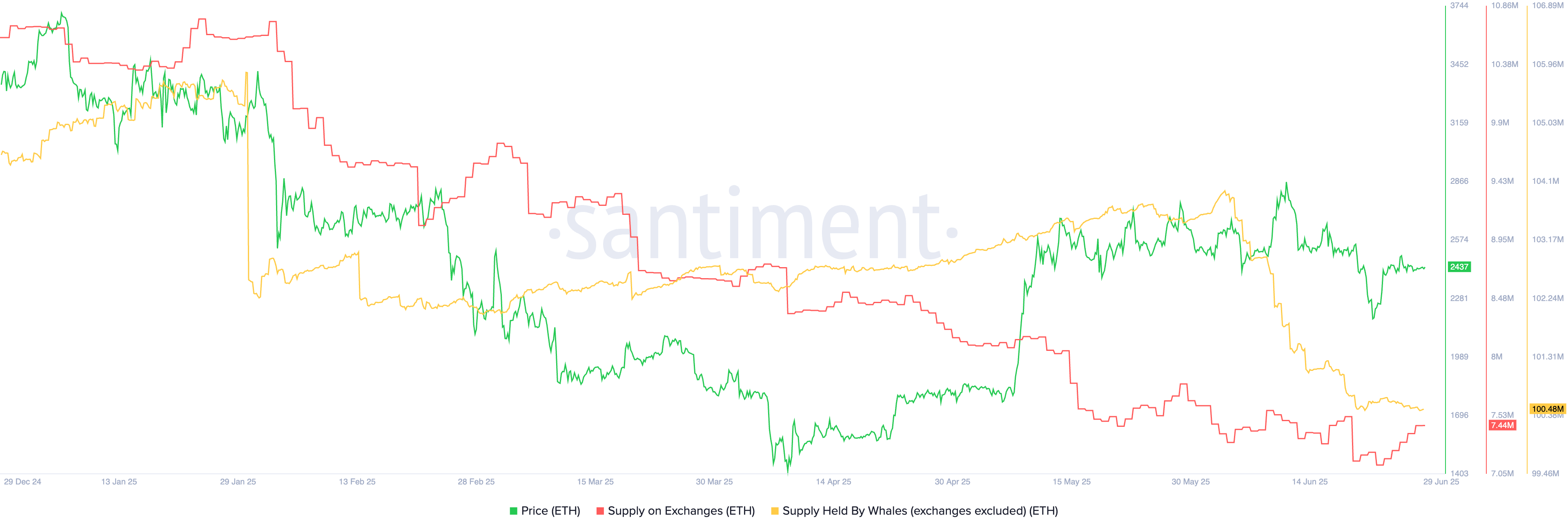

However, the ETH price faces three major risks that may impact its value. First, on-chain data shows that the supply of ETH on exchanges has risen to 7.44 million, up from this month’s low of 7.12 million.

Rising exchange balances are a sign that investors are selling their tokens, potentially to take profits after it surged in May.

Further data show that the supply held by whales has plummeted to 100.48 million, down from the year-to-date high of 103.9 million. Whale dumping is also a sign that they expect the price to fall.

Ethereum price analysis

The other risk is that ETH price has dropped below the 200-day Exponential Moving Average, a sign that bears have prevailed. The last time ETH fell below the 200-day moving average was in February, and it subsequently crashed by over 55%.

Ethereum price also invalidated the bullish flag pattern by moving below the lower side of the flag section. It has then retested this price, signaling that a potential continuation is possible. Therefore, there is a risk that the token will drop below $2,000 in the near future.