The eponymous investor discussed Q1 financial results—including a review of $MSTR, $STRK and $STRF—as well as forward-looking statements no investor should miss.

In an earnings call on May 1, Michael Saylor, the CEO and engineer of the wildly successful BTC (BTC) Treasury firm Strategy, stated emphatically that the firm is playing a crucial role in expanding institutional interest.

On the call, Saylor began by reiterating BTC’s unique value proposition: “Bitcoin has no counterparty risk,” the investor stated, “No company. No country. No creditor. No currency. No competitor. No culture. Not even chaos.”

He added that global adoption has been moving forward expeditiously, whilst predicting that “the First Nation to print their own currency to buy Bitcoin wins.”

“The adoption of the Bitcoin standard by more companies is beneficial, legitimizing Bitcoin and attracting more capital. As more companies join, it stabilizes and drives up Bitcoin’s price,” Saylor said.

Highlighting Strategy’s capital market maneuvers, which say the treasury raise $7.7 billion in Q1 through common stock, convertible notes, and preferred stock IPOs to acquire 61,497 BTC, the Q1 earnings report stated that it had achieved a 13.7% “BTC Yield” and $5.8 billion “BTC $ Gain” year-to-date.

In addition, Saylor celebrated BTC’s adoption by over 70 public companies, framing Strategy as a leader in a “digital gold rush.” He dismissed BTC’s volatility concerns, emphasizing long-term appreciation, and justified debt-fueled purchases as accretive, despite a $4.2 billion net loss from unrealized fair value losses.

Saylor’s bullish vision casts BTC as digital capital poised to dominate finance, but he glossed over risks like price swings, leverage, and potential shareholder dilution from perpetual preferred stock dividends.

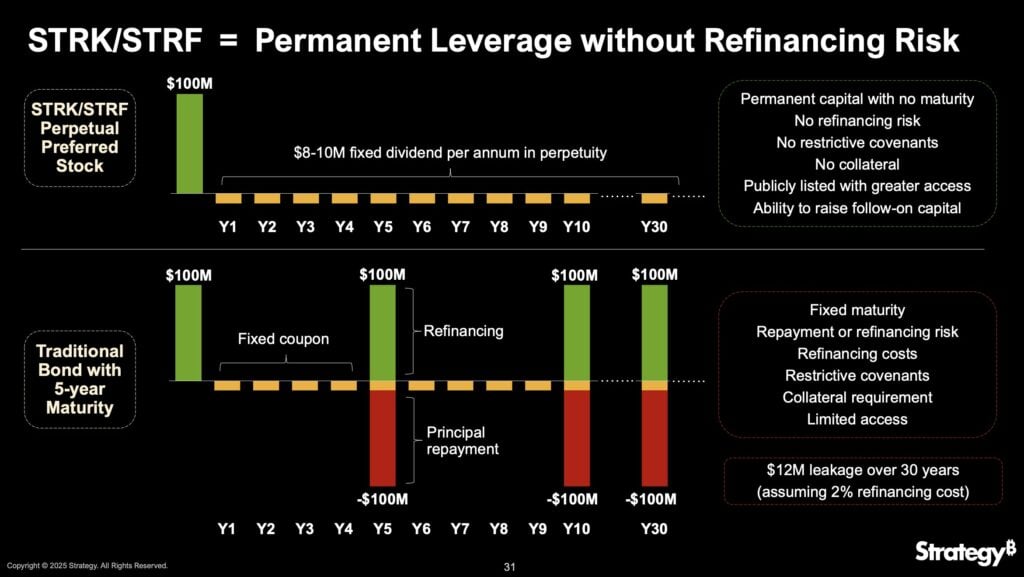

However, critics have pointed out numerous issues with Strategy’s highly leveraged model. While the company touts a 50% share price increase and a $12.7 billion retained earnings boost from fair value accounting, its reliance on bonds to fund BTC purchases introduces significant risks. Issuing $2 billion in 0% Convertible Senior Notes due 2030 and perpetual preferred stock with high dividend obligations (8% for STRK, 10% for STRF) commits Strategy to substantial liabilities. These instruments, while providing capital, encumber the balance sheet with senior claims that could erode shareholder value if BTC’s volatility turns south.

Nevertheless, Saylor remains bullish, posting an aptly generated AI image to X shortly after the call.