While Ethereum is gaining momentum with huge investors injecting it with dollars and ambitious Ethereum treasury companies starting to pop up, the Ethereum exit queue began to grow quickly after July 16. It doubled between July 23 and July 24, exceeding 680,000 ETH by the evening. This sum is equivalent to $2.5 billion. What does it signal? If people prefer to sell their ETH holdings rather than stake them, does it mean the price will go down soon?

Summary

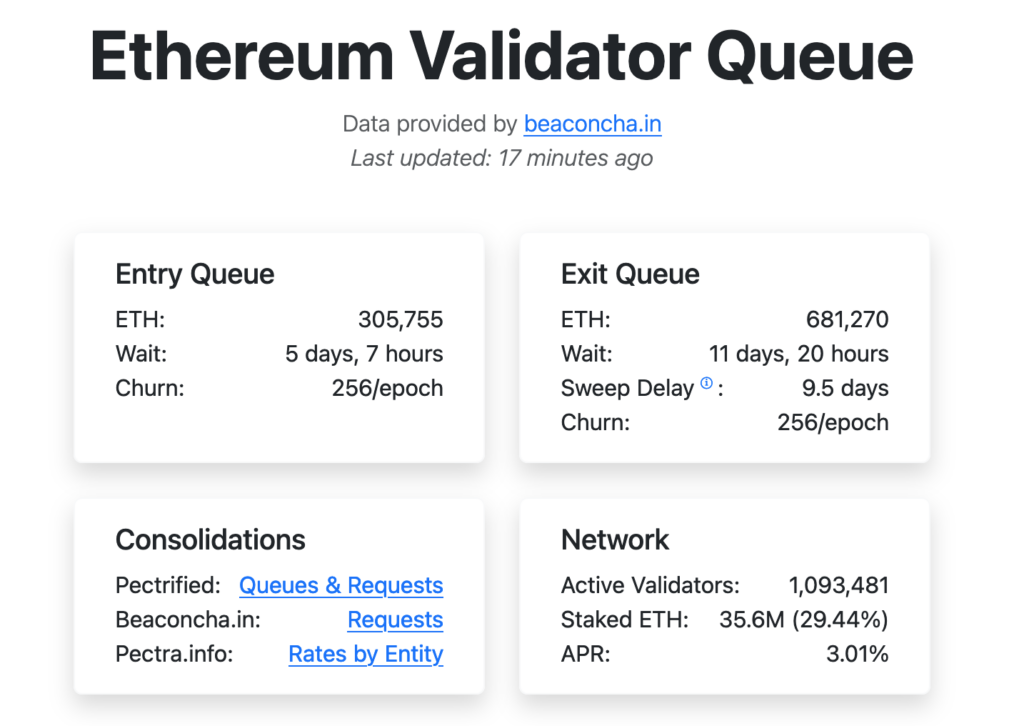

- $2.5 billion worth of Ether will be unstaked in around 11 days. It is the biggest exit queue in Ethereum’s history

- The entry queue is way smaller than the exit one, but still, it is the biggest since April 2024

- Spike in Ethereum unstaking may be explained by various reasons, including locking in profit and redefining staking and investing models, and is not an outright bearish signal, considering growing institutional and corporate demand for ETH

Excessive Ethereum exit queue

If the owners of the stake ETH coins want to use them otherwise (for instance, to sell them), they need to unstake them. To do so, they need to wait for a while in the queue that is called an “exit queue.” Those wishing to stake their ETH coins are waiting in line, respectively. These queues ensure the seamless operation of the network. The waiting time may vary depending on the number of validators in the queue. It rarely lasts for several days.

As of July 24, the waiting time has reached nearly 12 days. Before July 16, it took less than an hour to unstake Ethers. The current spike in the ETH exit queue is a record high, beating the Jan. 5, 2024, spike in which over 500,000 units of staked ETH were waiting in the exit queue.

The waiting time can grow even further, and those who want to use their ETH coins for purposes other than staking will be able to do so in two to three weeks, or possibly later.

What triggered such a quick growth of the exit queue?

Reasons for such a long queue, which some compare to Black Friday lines, are multiple. One of the possible reasons is that long-time stakers are going to lock in profits. The ETH price achieved a $3,000 milestone for the first time since February on July 12, 2025, four days before the exit queue became notably big. Probably, many stakers saw the $3,000 threshold as the price at which they feel comfortable cashing out.

However, locking in profit is not the only possible reason for this immense unstaking spike. One of the contributing factors was the volatility of the ETH borrow rate on DeFi platforms. It could trigger unstaking as investors needed ETH to repay their loans.

Possibly, the changes to the Ethereum network functioning contributed to the formation of an excessive exit queue. In May, the Ethereum network saw an important update called Pectra. It crucially increased staking flexibility, increasing the stake upper limit from 32 ETH to 2,048 ETH.

While the Pectra upgrade went live on the mainnet on May 7, it could contribute to the queue growth now, as the ETH price has increased. Validators may be restructuring their stakes, merging several small stakes into big ones, as it’s easier to manage one 320 ETH stake than ten 32 ETH stakes.

ETH ETF Flows

July 2024 – June 2025: $4.2 billion

July 2025: $4.4 billion

👀

— Matt Hougan (@Matt_Hougan) July 24, 2025

Another possible reason is the change in investment strategy, which involves switching from staking to buying Ethereum ETFs or investing in Ethereum treasury companies. Ethereum enjoys the biggest Ether ETF inflows. Within July, Ethereum ETF inflows totaled $4.4 billion, surpassing the combined total for the previous 12 months. BlackRock’s Ethereum ETF, the iShares Ethereum ETF, is the third-fastest-growing ETF. It grew from $5 billion to $10 billion within five days.

Is the ETH price about to go down?

While the number of people waiting to unstake and likely sell their Ethers is unusually high, the overall context doesn’t signal a bearish case. Firstly, it’s worth noting that although the exit queue is twice as large as the entry queue, the latter is not small. It grew significantly during the summer, too. It went from 147,000 ETH on July 12 to 435,000 ETH on July 17.

Over the next several days, it dropped to a 326,000 ETH level, which is still double the July 12 mark and significantly above the May levels, which were below 50,000 ETH. Nearly half the amount of Ether that will be unstaked in 12 days will be staked by those waiting in the entry queue in five days.

Moreover, given the growing demand for ETH from corporations and institutions, the impact of validators who sell their ETH may not be significant. ARK’s Cathie Wood recently sold Coinbase and Roblox shares to invest in Thomas Lee’s Ethereum treasury company Bitmine. BlackRock, Bernstein, Binance, Peter Thiel, and many others have increased their Ethereum holdings by millions of dollars. Furthermore, the passage of the GENIUS Act is viewed as a catalyst for increased demand for Ethereum in the future, as it facilitates the stablecoin network, which is partially built on the Ethereum blockchain.

If the Ethers that may soon be sold end up in the custody of treasuries or financial institutions, their price will increase, just as it has with Bitcoin. However, if they get sucked into speculative markets, the correction may follow, but it won’t necessarily fully undermine the uptrend.